Skrill is a world leader in payment solutions, whether you're gambling, trading on forex sites, or sending money to friends and family around the world. Its fast, efficient, and secure method of transferring funds is the reason it earned that top spot. This review delves into Skrill's offerings, evaluating how they stack up against the competition and what benefits they provide to users.

Key Takeaways

Global Reach: Operates in over 200 countries and supports multiple currencies.

Secure and Reliable: Regulated by the FCA and SEC, and employs top-tier encryption and security measures.

Diverse Services: Offers P2P payments, merchant transactions, crypto, and forex services.

Exclusive Benefits: Enhanced perks when joining through eWalletBooster.

User-Friendly Cards: Provides both physical and virtual prepaid MasterCards.

What is Skrill?

Skrill is a global company based in London with offices throughout Europe and the US. Its staff of over 500 represents more than 30 nationalities. As a UK-based company, Skrill is regulated by the Financial Conduct Authority (FCA), ensuring high standards similar to other reputable financial institutions.

Skrill accounts can be held in any major currency, but once the first transaction is made, the account currency cannot be changed. Skrill also allows users to buy and sell cryptocurrencies, including Bitcoin, Bitcoin Cash, Ether, Ethereum Classic, Litecoin, XRP, and 0x.

Is Skrill Safe?

Skrill is one of the most secure e-money services in the world. It employs industry-leading risk and anti-fraud technology, along with multiple added layers of security. Skrill uses modern SSL encryption and highly encourages users to activate Two-Factor Authentication (2FA).

Skrill's most recent account releases show a net worth of £344m+. Its parent company, Paysafe Group, is listed on the FTSE 250 Index. Paysafe is a multinational company owning Skrill, Neteller, and Paysafecard/Paysafecash. Skrill is regulated by both the British FCA and the American Securities and Exchange Commission (SEC), making it incredibly trustworthy.

How Does Skrill Work?

To use Skrill for either its wallet or money transfer service, you first need to create a Skrill account. This simple process takes only a few minutes and requires:

An email address

Name

Address

Preferred currency (USD, EUR, GBP, etc.)

After registration, you can immediately make money transfers and use the Skrill e-wallet for gambling, forex, and crypto transactions. To increase your e-wallet transaction limits and order a physical or virtual Prepaid MasterCard, you will need to verify your Skrill account.

Skrill Cards

Skrill Prepaid Mastercard

Owning a Skrill Prepaid Mastercard allows you to access your Skrill account balance anywhere in the world where Mastercard is accepted. The card is available in four currencies: EUR, GBP, USD, and PLN, and is only available to residents of authorized European Economic Area (EEA) countries. A verified Skrill account and a minimum balance of €10 are required to request your card.

Skrill Prepaid Mastercard Fees

Non-VIP | Silver | Gold | Diamond | |

Prepaid MasterCard Application Fee | €10 | FREE | FREE | FREE |

Daily ATM Withdrawal Limit | €900 | €1,500 | €3,000 | €5,000 |

ATM Withdrawal Fee | 1.75% | FREE | FREE | FREE |

Daily POS (Merchant) Limit | €2,700 | €3,000 | €5,000 | €10,000 |

FX Fee | 3.99% | 2.89% | 2.59% | 1.99% |

Replacement Fee | €10 | FREE | FREE | FREE |

Annual Fee | €10 | FREE | FREE | FREE |

Skrill Virtual MasterCard

The Skrill Virtual MasterCard allows you to make online payments instantly wherever Mastercard is accepted. The virtual card is activated immediately, so you can start using it as soon as you have funds in your Skrill wallet. The first card is free, with an annual fee of €10.

Skrill Virtual MasterCard Limits

Currency | Limit |

EUR | 6,300 |

USD | 7,000 |

GBP | 4,550 |

PLN | 23,000 |

Skrill Virtual MasterCard Fees

Category | Fees |

Pay for Goods | FREE |

Balance Enquiries | FREE |

Online Statements | FREE |

First Virtual Card | FREE |

Subsequent Cards | €2.50 |

Foreign Exchange Fee | 3.99% |

Skrill Fees

For a full breakdown, read our dedicated Skrill fees and limits article.

Skrill Deposit Fees & Time

Method | Charge | Timeframe |

Manual bank transfer | 1% | Up to 5 business days |

Fast bank transfer | 1% | Instant |

Rapid transfer | 1% | Instant |

Neteller | 1% | Instant |

Bitcoin/BTC Cash | 1% | Instant |

Paysafecard | 1% | Instant |

Trustly | 1% | Instant |

Klarna | 1% | Instant |

Credit/debit card | 1% | Instant |

Skrill Withdrawal Fees

Method | Fee |

Bank transfer | €5.50 |

Visa | 7.5% |

Swift | €5.50 |

Skrill to Skrill Fees

For Skrill VIPs, there is no charge applied to P2P (peer-to-peer) transfers. However, non-VIPs pay a 1.45% fee on P2P transfers. Receiving funds to your Skrill account from another Skrill member is free.

Read our full Skrill-to-Skrill transfer fees and limits guide.

Skrill to Neteller Fees

There is a 1% charge for sending money from Skrill to Neteller and vice versa.

Skrill to Bank Account

There is no fee for using the Skrill money transfer service to transfer directly to a bank account anywhere in the world.

Send Money from PayPal to Skrill

There is no direct way to transfer funds from PayPal to Skrill. However, you can use several indirect methods, though these can take a long time and require multiple accounts.

Skrill Support

Skrill has an in-depth support section where you can usually resolve your issue by browsing the topics. If you cannot find the answer, you can email them or, for urgent queries, call Skrill customer service via their support numbers.

Country | Number | Available |

International | +44 203 308 2520 | Mon-Sun 8am - 5pm GMT |

Russia | +7 495 249 5439 | 11am - 8pm Moscow time |

Spain | +34 935 452 390 | Mon-Sun 9am - 6pm local time |

UK | +44 203 308 2519 | Mon-Sun 8am-5pm local time |

France | +33 173 443 315 | Mon-Sun 9am - 6pm local time |

Germany | +49 302 2403 0293 | Mon-Sun 9am - 6pm local time |

Italy | +39 064 5236612 | Mon-Sun 9am - 6pm local time |

Poland | +48 221 288 257 | Mon-Sun 9am - 6pm local time |

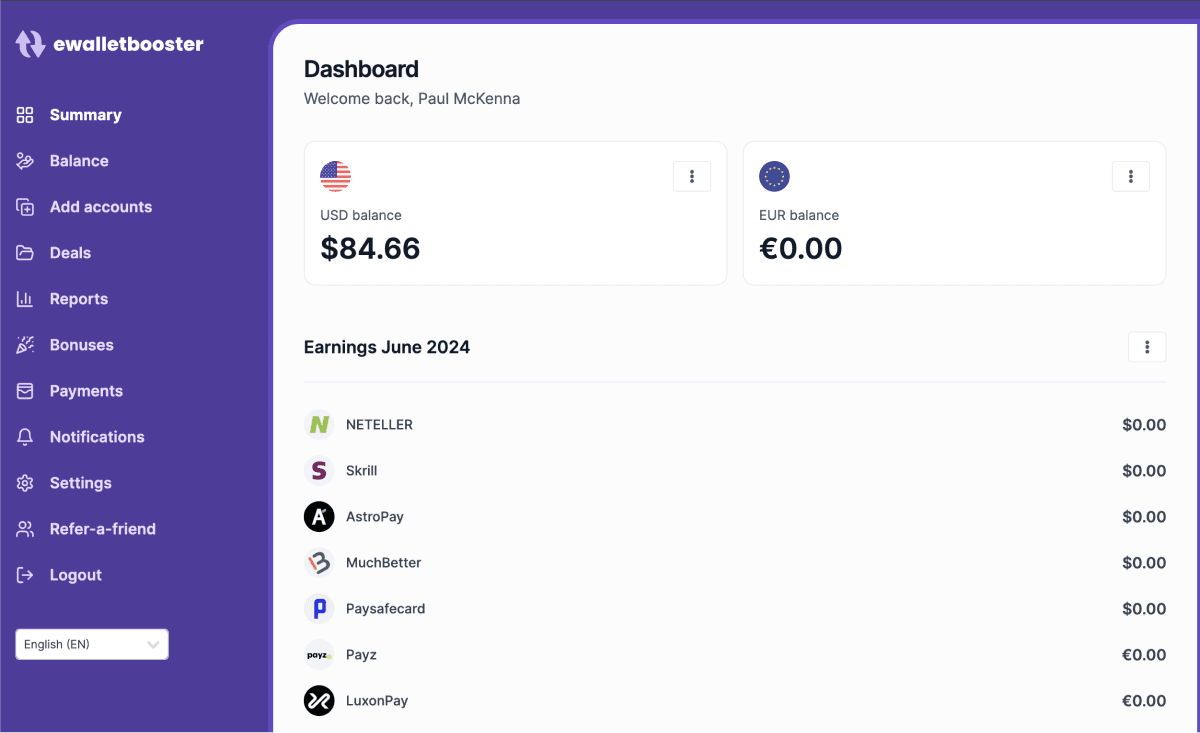

🚀 Exclusive Benefits with eWalletBooster

By partnering with eWalletBooster, you can access exclusive benefits with your Skrill account:

Skrill 'Fast Silver' VIP status

Silver for €6k instead of €15k

Free verification: No deposit required

Fast-track verification

Free P2P transfers as Silver VIP

Free prepaid Mastercard as Silver VIP

Save money with 2.89% forex fee

$30 eWalletBooster sign-up bonus

Monthly cashback via eWalletBooster rewards dashboard

Frequently asked questions

Is Skrill Safe?

Yes, Skrill is highly secure, employing industry-leading risk and anti-fraud technology. It is regulated by both the FCA and SEC, ensuring strict compliance and trustworthiness.

What services does Skrill offer?

Skrill provides P2P payments, merchant transactions, forex trading, and cryptocurrency services. It also offers both physical and virtual prepaid MasterCards.

How do Skrill fees compare to other e-wallets?

Skrill's fees are competitive, often lower than similar services. VIP users benefit from reduced fees, especially for P2P transfers and currency conversions.

How do I get a Skrill prepaid MasterCard?

You can get a Skrill prepaid MasterCard by achieving VIP status. Joining Skrill through eWalletBooster can help you fast-track to Silver VIP status, ensuring your card is delivered at no cost.

What are the benefits of the Skrill VIP programme?

The Skrill VIP programme offers reduced fees, higher transaction limits, free P2P transfers, and free prepaid MasterCards. Higher-tier VIPs enjoy even more benefits like increased support and cashback on transfers.

Conclusion

Skrill stands out in the e-money transfer service market with its robust security, competitive fees, and comprehensive VIP programme. By partnering with eWalletBooster, you can unlock even more benefits, making Skrill an excellent choice for managing your online transactions. Start your journey with Skrill today and take advantage of all the exclusive perks it offers.

Get a FREE Fast Silver VIP Upgrade on Your Skrill account with eWalletBooster

Skrill 'Fast Silver' VIP status

Silver for €6k, instead of €15k

Verify for FREE: no deposit required

Fast-track verification

FREE P2P Transfers as Silver VIP

FREE prepaid Mastercard as Silver VIP

Save money with 2.89% forex fee

$30 sign up bonus when you join

Further Reading

If you found this article helpful, you might also like:

- Unlock Skrill Cashback and VIP Perks with eWalletBooster!

- Skrill Fees and Limits 2024: Comprehensive Guide & How to Save Money with eWalletBooster

- Skrill Registration Guide: Step-by-Step Process & Exclusive Benefits

- Skrill to Skrill Fees and Limits 2024: How to Save with eWalletBooster

- Skrill Verification Guide 2024: Fast-Track Your Account and Unlock Exclusive Benefits

- Unlock Exclusive Benefits with Skrill's VIP Program Today!