Payz, formerly known as ecoPayz, is one of the longest-standing and most widely trusted e-money transfer services in the world. With its secure, speedy, and user-friendly platform, Payz offers a comprehensive range of financial services. This detailed review will cover the history, security systems, VIP programme, and fee/limit structure of Payz, plus some exclusive benefits you can unlock through eWalletBooster.

Key Takeaways

Secure and Reliable: Payz uses state-of-the-art security and encryption systems.

Extensive VIP Programme: Enjoy reduced fees, higher limits, and exclusive perks.

No P2P Transfer Fees: Transfer funds to friends and family for free.

Exclusive eWalletBooster Benefits: Access additional perks like free verification and cashback.

Diverse Financial Services: Supports multiple currencies, prepaid cards, and more.

What is Payz?

Founded in 2000, Payz (formerly ecoPayz) is one of the most established and trusted e-wallets globally. While it may not be as large as Skrill or Neteller, Payz is the third biggest e-wallet and is experiencing rapid growth.

Payz offers five main products:

ecoAccount

ecoCard

ecoVirtualcard

ecoPayz Business Account

ecoPayz Merchant Account

The ecoAccount is the primary offering that most users will interact with daily. Available in dozens of countries and over 50 global currencies, the ecoAccount can be linked to prepaid and virtual cards in the EU/EEA states. Though Payz does not have the same level of merchant coverage as Skrill and Neteller, it is growing, adding big names like Betfair to its list of serviced merchants.

Is Payz Safe?

Absolutely. Payz employs top-tier security measures and encryption systems to protect your funds. As a UK-based company, Payz is regulated by the British Financial Conduct Authority (FCA). They are registered with the Information Commissioner's Office, accredited by PSI-Py Ltd., and the Thawte Certification Authority, and are PCI DSS compliant.

These accreditations and regulatory measures ensure that Payz is a trustworthy platform, offering peace of mind for its users.

Payz Review: Features and Benefits

Fees & Limits

Payz's fees are competitive, often lower than similar services. Notably, Payz offers free peer-to-peer (P2P) transfers for regular customers, a significant advantage over Skrill and Neteller.

Silver | Gold | Platinum | VIP | |

Bank Wire Deposit Fee | 0.00-7.00% | 0.00-7.00% | 0.00-7.00% | 0.00-7.00% |

Credit Card Deposit Fee | 1.69-2.90% | 1.69-2.90% | 1.69-2.90% | 1.69-2.90% |

Bank Withdrawal Fee | €5.90-€10 | €5.90-€10 | €5.90-€10 | €2.90-€7 |

Currency Conversion | 2.99% | 1.49% | 1.49% | 1.25% |

Max Account Balance | €15,000 | €100,000 | €120,000 | Unlimited |

MasterCard

The ecoCard prepaid Mastercard offers low fees and free cards for VIPs. By joining with eWalletBooster, you can get a free Gold VIP upgrade, ensuring your card is delivered at no cost. Note that non-VIP users cannot order the ecoCard prepaid MasterCard.

Silver | Gold | Platinum | VIP | |

Card Issue, Activation Fee | FREE | FREE | FREE | FREE |

Cash Withdrawal Fee | 2.00% (min. €1.50) | 2.00% (min. €1.50) | 2.00% (min. €1.50) | 2.00% (min. €1.50) |

Currency Conversion Fee | 2.99% | 2.99% | 2.99% | 2.99% |

Max Single ATM Transaction | €250 | €500 | €500 | €500 |

Max Daily ATM Transaction | €1000 | €2500 | €2500 | €2500 |

Max Single POS/eCommerce Transaction | 5 | 8 | 8 | 8 |

Max POS/eCommerce Transactions Per Day | €750 | €1500 | €1500 | €1500 |

Security

Payz uses modern encryption and security services to ensure the safety of your money. Key security measures include:

Modern Encryption: Payz uses PCI DSS-compliant encryption.

Two-Factor Authentication (2FA): Strongly recommended for added security.

User Verification: All users must be fully verified to prevent fraud.

Payz’s security team is proactive, quickly addressing any potential breaches to protect your funds.

VIP System

Payz offers one of the best VIP programmes in the market. Each VIP tier provides additional functionality, lower fees, and higher account limits. Upon registration, you get a Classic account, and after verification, you achieve Silver VIP. Higher tiers offer even more benefits.

Classic | Silver | Gold | Platinum | VIP | |

Requirements | Registration | Verification | See below | See below | See below |

Deposit Threshold | N/A | N/A | €5,000 or eWalletBooster | €50,000 | €250,000 |

Benefits | Basic | Enhanced | Significant | Extensive | Maximum |

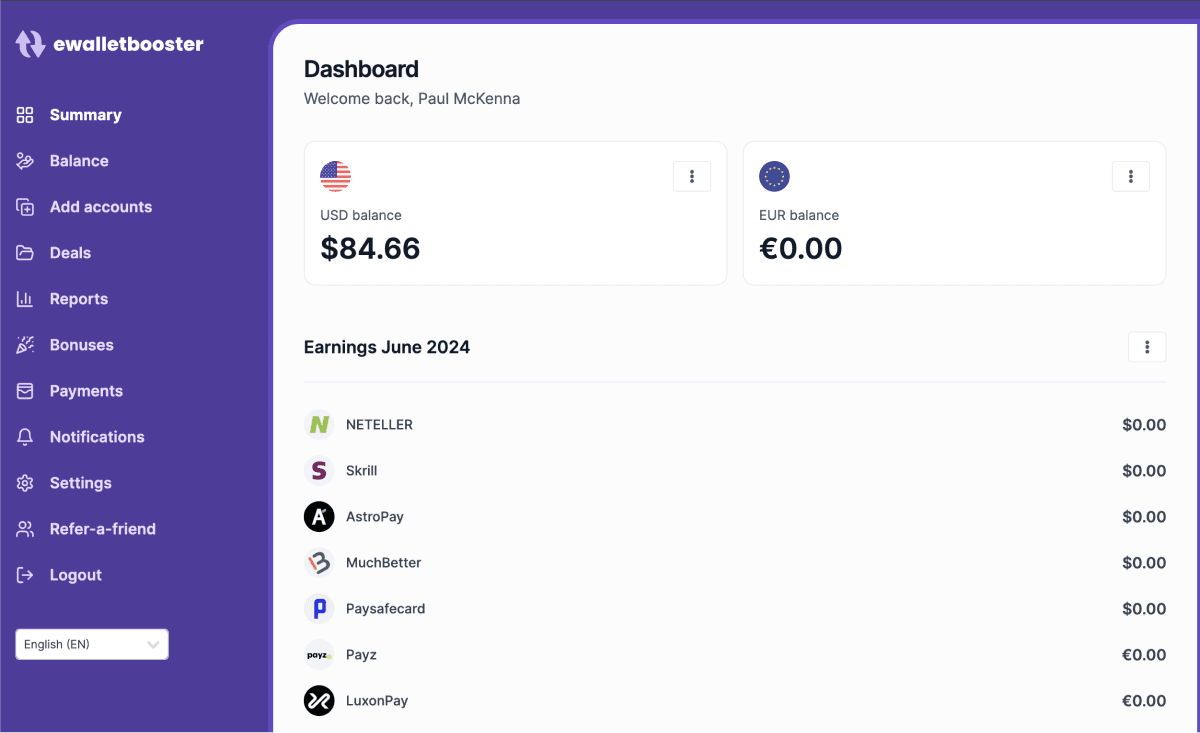

🚀 Exclusive Benefits with eWalletBooster

By partnering with eWalletBooster, you can access exclusive benefits with your Payz account:

Get Payz “Gold VIP” status for FREE

Earn cashback on your transfers via eWalletBooster rewards dashboard

FREE P2P transfers as Gold VIP (usually 1.5%)

FREE Verification (no deposit required!)

Discounted 1.49% FX Fee as Gold VIP (usually 2.99%)

Monthly eWalletBooster cashback via eWalletBooster rewards dashboard

Frequently Asked Questions

Is Payz Safe?

Yes, Payz is highly secure, using modern encryption and complying with PCI DSS standards. They are regulated by the British Financial Conduct Authority (FCA) and have multiple accreditations ensuring their trustworthiness.

What services does Payz offer?

Payz offers various services including the ecoAccount, ecoCard, ecoVirtualcard, ecoPayz Business Account, and ecoPayz Merchant Account. These services support multiple currencies and provide options for both personal and business use.

How do Payz fees compare to other e-wallets?

Payz fees are competitive, often lower than those of Skrill and Neteller. Payz also offers free P2P transfers for regular customers, which is a significant advantage.

How do I get a Payz prepaid MasterCard?

You can get a Payz prepaid MasterCard by achieving a VIP status. Non-VIP users cannot order the ecoCard prepaid MasterCard. Joining Payz through eWalletBooster can help you fast-track to Gold VIP status, ensuring your card is delivered at no cost.

What are the benefits of the Payz VIP programme?

The Payz VIP programme offers reduced fees, higher transaction limits, free P2P transfers, and free prepaid MasterCards. Higher-tier VIPs enjoy even more benefits like increased support and cashback on transfers.

Conclusion

Payz stands out in the e-money transfer service market with its robust security, competitive fees, and comprehensive VIP programme. By partnering with eWalletBooster, you can unlock even more benefits, making Payz an excellent choice for managing your online transactions. Start your journey with Payz today and take advantage of all the exclusive perks it offers.

Get a FREE Gold VIP Upgrade on Your Payz account with eWalletBooster

Get Payz “Gold VIP” status for FREE

Earn CASHBACK on your transfers

FREE P2P transfers as Gold VIP (usually 1.5%)

FREE Verification (no deposit required!)

Fast-track verification (usually 1-5 days)

Discounted 1.49% FX Fee as Gold VIP (usually 2.99%)

Further Reading

If you found this article helpful, you might also like:

- Maximize Your Earnings with the Payz Affiliate Program on eWalletBooster!

- Unlock Payz Cashback and VIP Perks with eWalletBooster!

- Payz Fees and Limits 2024: Optimize Your Savings with eWalletBooster

- How to Register for Payz: A Complete Guide + How to Get a Signup Bonus

- Payz Verification Guide 2024: Fast-Track Your Account and Unlock Exclusive Benefits