When managing your finances online, understanding the fees associated with digital wallets is crucial. AstroPay, a popular e-wallet solution, offers a convenient way to handle transactions, but it's essential to be aware of the costs involved. By comparing AstroPay fees with those of other e-wallet providers like Skrill and Neteller, you can make an well-informed choice that best suits your needs.

You'll also discover how linking your AstroPay account to ewalletbooster.com can unlock exclusive benefits such as a Black VIP upgrade, fast-track verification, and lifetime monthly cashback.

Key Takeaways

Fee Structure: Generally lower fees compared to other e-wallets, with most services incurring no charges.

Fee-Free Domestic P2P Transfers: Transferring funds between AstroPay users within the same country is free, which is not always the case with other e-wallet providers.

Exclusive Benefits via ewalletbooster.com: Linking your AstroPay account to ewalletbooster.com unlocks perks such as a free Black VIP upgrade, fast-track verification, and lifetime monthly cashback.

Comparison with Other Providers: AstroPay typically charges fewer fees than competitors such as Skrill, Neteller, and Payz.

What is AstroPay?

AstroPay is a global e-wallet service tailored to the needs of the gambling and trading industries. Known for its accessibility and convenience, AstroPay offers users a streamlined method to manage their finances online, making it a popular choice for individuals involved in these sectors.

AstroPay Fees, Explained

When it comes to fees, AstroPay stands out for its affordability. An overall analysis reveals that AstroPay’s fees are generally lower compared to other e-wallets. Most services, including deposits, withdrawals, peer-to-peer (P2P) transfers, sending money, and receiving money, incur no charges at all.

AstroPay Account Fees

AstroPay eliminates common e-wallet charges by not imposing registration or account fees. Unlike Payz (formerly ecoPayz), which deducts a monthly inactivity fee of €1.5 or Skrill which deducts €5.00 per month (if you do not log in or make a transaction at least once every 6 months), AstroPay doesn’t penalise you for dormant accounts.

This makes it a more user-friendly option, particularly for individuals who may not make frequent transactions. Setting up and maintaining your AstroPay account doesn’t come with any hidden or surprise costs, encouraging more users to select AstroPay as their preferred e-wallet service.

AstroPay Deposit Fees

AstroPay allows you to top up your account or purchase an AstroPay voucher without incurring deposit fees. You can freely add funds to your AstroPay wallet or buy vouchers, which differ from many other e-wallet services that often charge a fee for depositing money. This cost-efficiency in deposits can make it easier for you to keep your e-wallet balance topped up without worrying about additional deductions, enhancing the overall convenience of using AstroPay.

AstroPay Withdrawal Fees

Withdrawing funds from AstroPay via bank transfer involves no fees and via debit/credit card the fee is 0.5%. This fee-free withdrawal policy contrasts sharply with many e-wallet providers who typically impose charges for transferring funds out of your wallet. These zero-cost withdrawal options allow you to access your money seamlessly, so increasing the practical utility of using AstroPay for everyday transactions or larger financial activities.

AstroPay Forex Fees

AstroPay applies forex fees only when you exchange money between your account balances, allowing a maximum of two currencies. While AstroPay doesn’t publish specific FX rates, it does show the exchange rate (shown in the screenshot below) before making an exchange, enabling you to infer any associated fees. This transparency helps manage currency exchange costs more effectively.

AstroPay to AstroPay Fee (P2P)

Transferring funds between AstroPay users within the same country incurs no fees. Unlike other e-wallets, which provide international P2P transfers, AstroPay’s P2P feature is restricted to domestic transfers only. Nonetheless, the absence of fees for these transactions can make it easier and more economical to send money to friends and family members using AstroPay within your country.

🚀 Exclusive Benefits with ewalletbooster.com

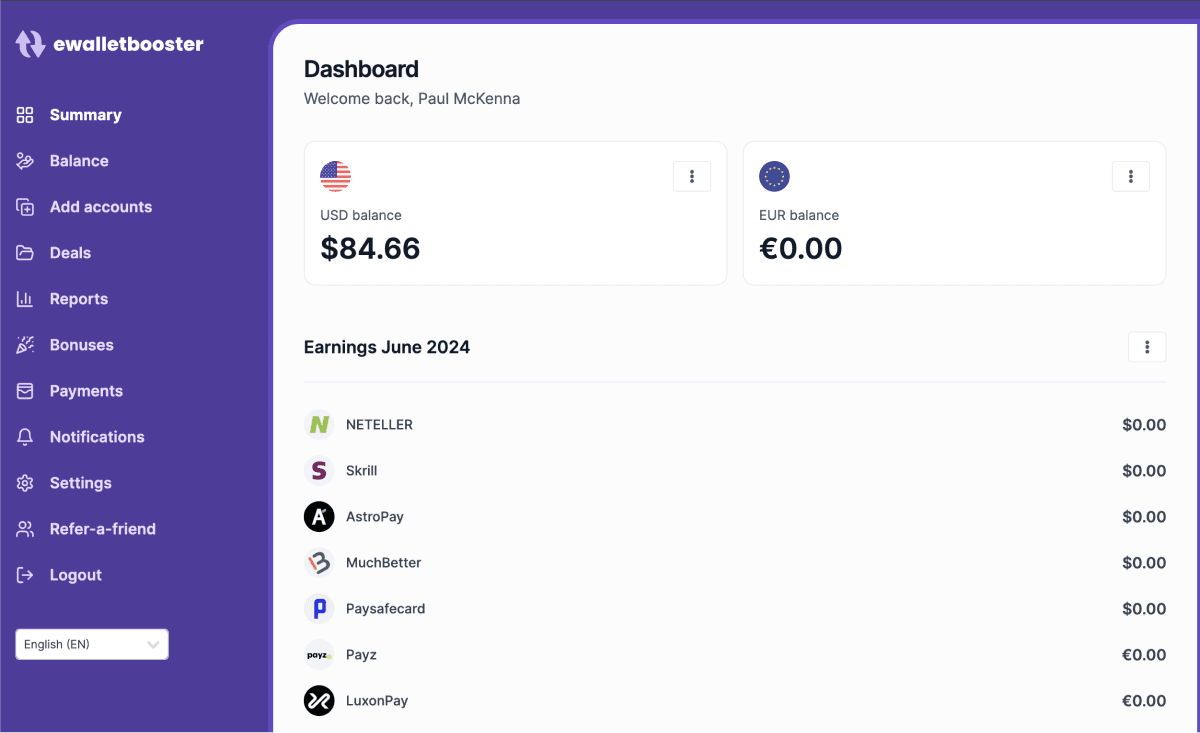

By linking your AstroPay account with ewalletbooster.com, you access several exclusive benefits designed to enhance your experience and provide additional value. These benefits include a free upgrade to AstroPay Black Level VIP, fast-track verification, and lifetime monthly cashback.

Free Upgrade to AstroPay Black Level VIP

When you connect your AstroPay account to ewalletbooster.com, you get a free upgrade to AstroPay Black Level VIP status. This VIP level provides several advantages such as the ability to earn AstroPoints which can be converted to cash, a dedicated "AstroConcierge" account manager and priority customer support.

Fast-Track Verification

Linking your AstroPay account to ewalletbooster.com also grants fast-track verification. The fast-track process reduces waiting times for account approvals, allowing you to use your AstroPay services more quickly. Your transactions will be processed faster, enhancing your overall experience by reducing delays. Read more about AstroPay verification.

Lifetime Monthly Cashback

One of the standout benefits of linking your account with us is the lifetime monthly cashback on transfers to merchants. The cashback is paid directly from ewalletbooster.com via our rewards dashboard and can provide significant savings over time, making your transactions more rewarding. Sign up to get AstroPay exclusive benefits now!

Summary of Benefits

To summarise, linking your AstroPay account with ewalletbooster.com provides:

Free upgrade to AstroPay Black Level VIP

Fast-track verification

Lifetime monthly cashback

These benefits are designed to offer you enhanced value and a superior user experience. Get started!

AstroPay Fees vs Other E-Wallet Providers

Generally, AstroPay charges almost no fees, making it a cost-effective option compared to other providers like Skrill, Neteller, and Payz, which charge higher fees. However, the fee structures of these providers can vary widely depending on the region and the specific service.

Deposit Fees

AstroPay deposits don't incur charges, making it cost-effective for users. In contrast, Skrill deposit fees range from 0% to 5%, depending on the method and region. For instance, bank transfers are free, while card deposits (VISA and Mastercard) range from 1% to 5%. Neteller’s fees also range between 1% to 5% by method and region, with bank transfers at 1%, though free for deposits over $20,000. For card deposits, Neteller charges between 1% and 5%, with an average of 2.5%. Payz fees vary by region, method, and VIP level, with bank wire deposits from 0% to 10%, and card deposits at 1.69% to 6.00% plus €0.25. MuchBetter.com deposits show more variation by region and method, with card deposits between 0% and 6% and bank transfers ranging from 0% to 10%.

Provider | Bank Transfer | Card Deposit (VISA/MC) | Other Methods |

AstroPay | Free | Free | Free |

Skrill | Free | 1% - 5% | 0% - 5% depending on method and region |

Neteller | 1%, Free over $20,000 | 1% - 5% | 1% - 5% depending on method and region |

Payz | 0% - 10% | 1.69% - 6.00% + €0.25 | Varies by method and VIP level |

MuchBetter | 0% - 10% | 0% - 6% | Varies by region and method |

Withdrawal Fees

AstroPay withdrawals are free via bank transfers, with a 0.5% fee when using debit/credit cards. Skrill's withdrawal fees vary by region, with bank transfer withdrawals generally free in the SEPA area but incurring a fixed rate of €5.50 in other regions. Card withdrawals range from 1.25% to 2.5%, and withdrawing from Skrill to Neteller incurs a 3.49% fee. Cryptocurrency withdrawals have a 2% fee. Neteller charges $10 for bank transfers, card withdrawals range from 0% to 3.99% for Mastercard and 1.99% to 7.5% for VISA, while crypto withdrawals have a 2% fee. To withdraw from Neteller to Skrill is 3.49%. Payz fees for bank transfers range from €5.90 to €10, reducing to €2.90 to €7.00 for VIP members.

Provider | Bank Transfer | Card Withdrawal (VISA/MC) | Crypto Withdrawal | Other Methods |

AstroPay | Free | 0.5% | N/A | N/A |

Skrill | Free (SEPA) | 1.25% - 2.5% | 2% | 3.49% (Skrill to Neteller) |

Neteller | $10 | 0% - 3.99% (MC), 1.99% - 7.5% (VISA) | 2% | 3.49% (Neteller to Skrill) |

Payz | €5.90 - 10 | N/A | N/A | Reduced to €2.90 - 7.00 for VIPs |

Forex Fees

AstroPay users only pay FX fees when exchanging between two account balances, capped at two currencies. The FX rate isn't published, but the exchange rate is shown. Skrill and Neteller both start with a 3.99% FX fee, reducing to 1.99% and 1.29% respectively for top-level VIPs. Payz starts at a 2.99% FX fee, decreasing to 1.25% at the top VIP level.

Provider | FX Fee | Reduced FX Fee (Top VIP Level) |

AstroPay | Based on exchange rate | N/A |

Skrill | 3.99% | 1.99% |

Neteller | 3.99% | 1.29% |

Payz | 2.99% | 1.25% |

Peer-to-peer Fees (P2P)

AstroPay P2P transfers are free, though only within the same country. Payz charges 1.5% but offers free transfers from Gold VIP upwards. Skrill has a 2.99% fee, free from Silver VIP upwards. Neteller also charges 2.99%, reducing to free for Silver VIP members and above. MuchBetter provides free P2P transfers.

Provider | P2P Fee | Reduced P2P Fee (VIP Level) |

AstroPay | Free (Same Country) | N/A |

Skrill | 2.99% | Free (Silver VIP upwards) |

Neteller | 2.99% | Free (Silver VIP upwards) |

Payz | 1.5% | Free (Gold VIP upwards) |

MuchBetter | Free | N/A |

AstroPay Fee Frequently Asked Questions

AstroPay's fee structure offers a significant advantage over many competitors. With no deposit fees and free bank transfer withdrawals, it's an appealing choice for those who value cost-effectiveness. The 0.5% fee for debit/credit card withdrawals is minimal compared to other e-wallets.

Also, the absence of fees for peer-to-peer transfers within the same country makes it a strong contender in the e-wallet market. By linking your AstroPay account with ewalletbooster.com, you can enjoy exclusive benefits like VIP upgrades, fast-track verification, and lifetime cashback, further enhancing your financial management experience.

Does AstroPay charge to send P2P transfers?

No, AstroPay P2P transfers are free.

Is AstroPay expensive?

AstroPay is very affordable compared to competitors, with almost all services (deposits, withdrawals, P2P, send money, receive money) incurring no charges.

Why does AstroPay charge for withdrawal?

AstroPay does not charge for bank withdrawals and only charges a 0.5% fee for card withdrawals, which is significantly cheaper than other providers.

🚀 Get a FREE BLACK VIP Upgrade on Your AstroPay account with eWalletBooster.

Verify for FREE: no deposit required

Fast-track verification

FREE P2P transfers

Black Level VIP status

Monthly ewalletbooster cashback

Further Reading

If you found this article helpful, you might also like:

- Unlock AstroPay Cashback and VIP Perks with eWalletBooster!

- AstroPay Limits Explained: Maximise Your Benefits with eWalletBooster

- How to Register for AstroPay and Unlock Exclusive eWalletBooster Bonuses

- AstroPay Verification: Secure Your Transactions and Unlock Exclusive Benefits

- Unlock the Ultimate Benefits with AstroPay's VIP Loyalty Program

- Detailed AstroPay Review: Discover Exclusive Benefits and Features