Navigating the various fees and limits associated with Payz can be complex. This guide provides a comprehensive overview of Payz fees and limits for 2024, ensuring you have the latest information. Additionally, discover how linking your Payz account with eWalletBooster can help you get the best deals and maximise your savings.

Key Takeaways

Comprehensive Fee Breakdown: Understand all applicable Payz fees.

VIP Benefits: Reduced fees and higher limits for VIP members.

Exclusive eWalletBooster Deals: Enjoy VIP upgrades, fast-track verification, and cashback.

User-Friendly Navigation: Easily find specific fees and limits for different transaction types.

Enhanced Support: Access priority customer support with VIP status.

Payz Fees Explained

From deposits and withdrawals to card, FX, and P2P transfer fees, there's a lot to remember when first getting started with Payz. Here’s a breakdown of each fee type:

Deposit Fees

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

Bank Deposit | 0.00-10.00% | 0.00-10.00% | 0.00-10.00% | 0.00-10.00% | 0.00-10.00% |

Credit Card Deposit | 1.69-6.00% + €0.25 | 1.69-6.00% + €0.25 | 1.69-6.00% + €0.25 | 1.69-6.00% + €0.25 | 1.69-6.00% + €0.25 |

EcoVoucher Deposit | 2.90% | 2.90% | 2.90% | 2.90% | 2.90% |

CodePayz Deposit | €0.00 - €3.50 | €0.00 - €3.50 | €0.00 - €3.50 | €0.00 - €3.50 | €0.00 - €3.50 |

ZestPay Deposit | 0.5-2.00% | 0.5-2.00% | 0.5-2.00% | 0.5-2.00% | 0.5-2.00% |

Withdrawal Fees

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

Bank Withdrawal | N/A | €2.90-€7.00 | €2.90-€7.00 | €2.90-€7.00 | €2.90-€7.00 |

ZestPay Withdrawal | N/A | 1.00%, min €5.90 | 1.00%, min €5.90 | 1.00%, min €5.90 | 1.00%, min €2.90 |

Withdrawal to Another Payz Account | N/A | 1.50%, min €0.50 | Free | Free | Free |

MasterCard Fees

Payz discontinued its virtual card in 2020 to focus on the physical MasterCard.

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

MasterCard Application Fee | N/A | Free | Free | Free | Free |

(UK) MasterCard Delivery Fee | N/A | £10 GBP | £10 GBP | £10 GBP | £10 GBP |

(EU) MasterCard Delivery Fee | N/A | £30 GBP | £30 GBP | £30 GBP | £30 GBP |

Card Replacement Fee | N/A | €12.50 | €12.50 | €12.50 | €12.50 |

Cash Withdrawal Limit | N/A | €750/per day | €1,500/per day | €1,500/per day | €1,500/per day |

FX Fee | N/A | 2.99% | 2.99% | 2.99% | 2.99% |

ATM Withdrawal Fee | N/A | 2.00%, min €1.50 | 2.00%, min €1.50 | 2.00%, min €1.50 | 2.00%, min €1.50 |

POS (Merchant) Limit | N/A | €5,500/per day | €11,000/per day | €11,000/per day | €11,000/per day |

Annual Fee | N/A | Free | Free | Free | Free |

Card Lifespan | N/A | 2 Years | 2 Years | 2 Years | 2 Years |

Payz to Payz Transfers (P2P) Fees

The P2P fees are straightforward:

Classic users: Cannot make P2P transfers without verifying.

Silver VIPs: Pay 1.5% with a €0.50 minimum.

Gold users and above: Make P2P transactions for free.

Connecting your eWalletBooster and Payz accounts instantly gives you Gold VIP status for free, skipping fees and unlocking account features. Get started here.

Forex Fees

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

Payz Account FX Fee | 2.99% | 2.99% | 1.49% | 1.49% | 1.25% |

MasterCard FX Fee | 2.99% | 2.99% | 2.99% | 2.99% | 2.99% |

Payz Limits

Your account limits are influenced by your VIP tier. Higher tiers mean higher limits.

Deposit Limits

While there are some reductions in fees as you progress through the account levels, the increases in account limits are more noticeable. However, the single most important thing is to verify your ecoPayz account, as the functionality available for unverified accounts is very limited.

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

Max Balance | €0 | €15,000 | €100,000 | €120,000 | Unlimited |

Credit/Debit (Single Transaction) | €200.00 | €1,000.00 | €1,500.00 | €2,000.00 | €2,500.00 |

Credit/Debit (Daily) | €200.00 | €3,000.00 | €5,000.00 | €6,000.00 | €7,000.00 |

Credit/Debit (Weekly) | N/A | €5,000.00 | €10,000.00 | €15,000.00 | €20,000.00 |

Bank Deposit (Single) | €1,000.00 | €15,000.00 | €100,000.00 | €120,000.00 | €140,000.00 |

Bank Deposit (Daily) | €1,000.00 | €15,000.00 | €100,000.00 | €120,000.00 | €140,000.00 |

Bank Deposit (Weekly) | N/A | €105,000.00 | €260,000.00 | €305,000.00 | €360,000.00 |

Bank Deposit (Monthly) | N/A | €400,000.00 | €1 Million | €1 Million | €1 Million |

EcoVoucher (Single) | €1,000.00 | €1,000.00 | €1,000.00 | €1,000.00 | €1,000.00 |

EcoVoucher (Daily) | €1,000.00 | €15,000.00 | €100,000.00 | €120,000.00 | €140,000.00 |

EcoVoucher (Weekly) | N/A | €105,000.00 | €260,000.00 | €305,000.00 | €360,000.00 |

EcoVoucher (Monthly) | N/A | €400,000.00 | €1 Million | €1 Million | €1 Million |

EFT Deposit (Single) | €50.00 | €100.00 | €200.00 | €300.00 | €500.00 |

EFT Deposit (Daily) | €50.00 | €100.00 | €200.00 | €300.00 | €500.00 |

EFT Deposit (Weekly) | €200.00 | €500.00 | €1,000.00 | €1,500.00 | €2000.00 |

EFT Deposit (Monthly) | €500.00 | €1,500.00 | €3,000.00 | €4,500.00 | €6,000.00 |

Neosurf Deposit (Single) | €30.00 | €30.00 | €30.00 | €30.00 | €30.00 |

Withdrawal Limits

Similar to deposit limits, the withdrawal limits also increase as you move up the VIP tiers. The highest limits are available for bank transfer withdrawals, with large amounts of up to €1 million on a weekly basis.

Classic Account | Silver VIP Account | Gold VIP Account | Platinum VIP Account | True VIP Account | |

Bank/ZestPay Withdrawal | N/A | €500,000.00 | €500,000.00 | €500,000.00 | €500,000.00 |

Bank/ZestPay (Daily) | N/A | €500,000.00 | €500,000.00 | €500,000.00 | €500,000.00 |

Bank/ZestPay (Weekly) | N/A | €1 Million | €1 Million | €1 Million | €1 Million |

P2P Transfer (Single) | N/A | €1,500.00 | €3,000.00 | €3,500.00 | €4,000.00 |

P2P Transfer (Weekly) | N/A | €5,000.00 | €10,000.00 | €15,000.00 | €25,000.00 |

P2P Transfer (Monthly) | N/A | €10,000.00 | €20,000.00 | €30,000.00 | €50,000.00 |

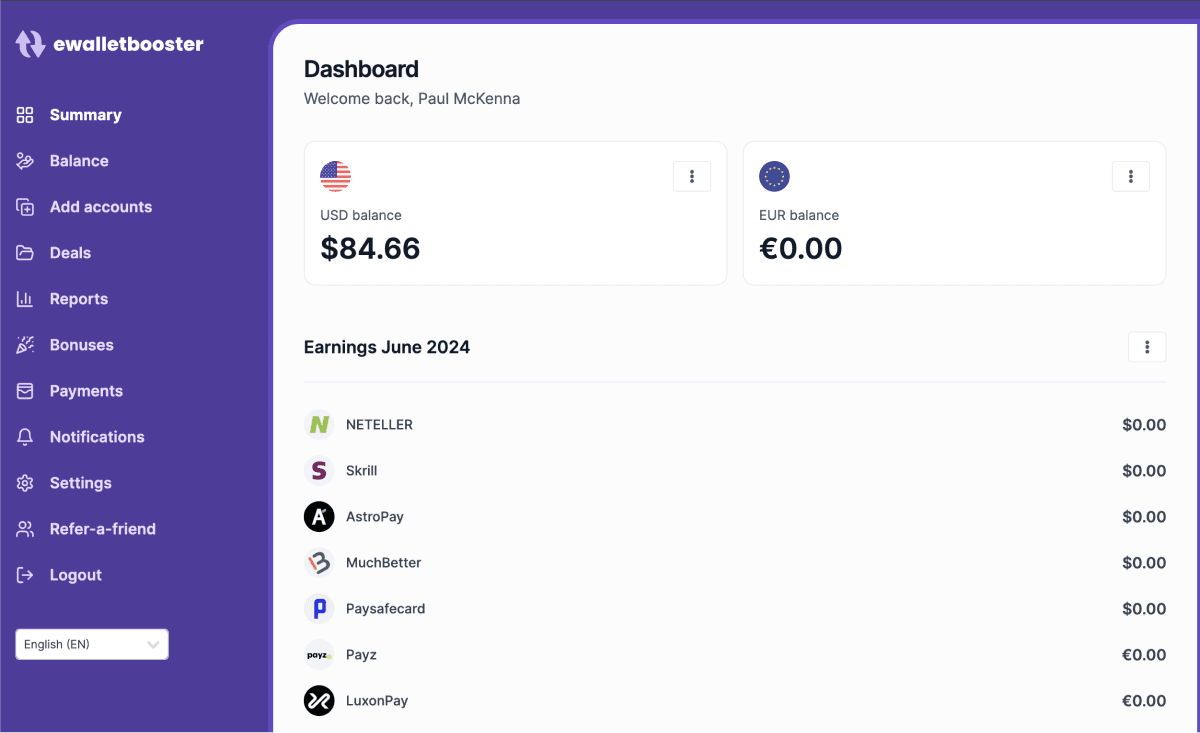

🚀 Exclusive Benefits with eWalletBooster

By linking your Payz account with eWalletBooster, you gain access to several exclusive benefits designed to enhance your experience and provide additional value:

Free "Gold VIP" Status: Upgrade to Payz Gold VIP for free.

Cashback on Transfers: Earn cashback on your transfers via the eWalletBooster rewards dashboard.

Free P2P Transfers: Benefit from free peer-to-peer transfers as a Gold VIP (usually 1.5%).

Free Verification: No deposit required for verification.

Discounted FX Fee: Enjoy a 1.49% FX fee as Gold VIP (usually 2.99%).

Comparison with Other E-Wallet Providers

Deposit Fees

Provider | Bank Transfer | Card Deposit | Other Methods |

Neteller | 2.5% (< $20,000) | 2.5% (< $20,000) | Varies |

Skrill | Free | 1-5% | 1-5% |

AstroPay | Free | Free | Varies |

Payz | 0-10% | 1.69-6% + €0.25 | Varies |

MuchBetter | 0-10% | 0-6% | Varies |

LuxonPay | Free | Free | Varies |

Withdrawal Fees

Provider | Bank Transfer | Card Withdrawal | Other Methods |

Neteller | $10 | 1.75% / $6 USD | 3.49% (Skrill) |

Skrill | Free (SEPA) | 1.25-2.5% | 3.49% (Neteller) |

AstroPay | Free | 0.5% | N/A |

Payz | €5.90-10 | 1.99-7.5% (VISA) | 1% ZestPay |

MuchBetter | 0-6% | FREE | Varies |

LuxonPay | €0-€20 | Fees not published | N/A |

Forex Fees

Provider | FX Fee |

Neteller | 3.99% (down to 1.29% for VIP) |

Skrill | 3.99% (down to 1.99% for VIP) |

AstroPay | Variable (exchange rate shown) |

Payz | 2.99% (down to 1.25% for VIP) |

MuchBetter | 0.99% |

LuxonPay | 2% (down to 0% for VIP) |

Peer-to-Peer Fees (P2P)

Provider | P2P Fee |

Neteller | 2.99% (free for VIP) |

Skrill | 2.99% (free for VIP) |

AstroPay | Free (same country) |

Payz | 1.5% (free for VIP) |

MuchBetter | Free |

LuxonPay | Free |

Payz fees & limits Frequently Asked Questions

What are the standard Payz deposit fees?

The standard deposit fees for Payz vary depending on the method used. Bank deposits can range from 0.00% to 10.00%, and credit card deposits range from 1.69% to 6.00% + €0.25.

How can I check my Payz deposit and withdrawal limits?

Log into your Payz account, select the deposit or withdrawal section, choose your method, and the limits will be displayed.

What are the benefits of linking Payz with eWalletBooster?

By linking your Payz account with eWalletBooster, you get free "Gold VIP" status, cashback on transfers, free P2P transfers, free verification, and a discounted FX fee of 1.49%.

Are Payz to Payz transfers free for VIP members?

Yes, Payz to Payz transfers are free for Gold VIP members and above.

How do I become a Gold VIP member with Payz?

Link your Payz account with eWalletBooster to receive an instant upgrade to Gold VIP status for free.

Get a FREE Gold VIP Upgrade on Your Payz account with eWalletBooster

Get Payz “Gold VIP” status for FREE

Earn CASHBACK on your transfers

FREE P2P transfers as Gold VIP (usually 1.5%)

FREE Verification (no deposit required!)

Fast-track verification (usually 1-5 days)

Discounted 1.49% FX Fee as Gold VIP (usually 2.99%)

Further Reading

If you found this article helpful, you might also like:

- Maximize Your Earnings with the Payz Affiliate Program on eWalletBooster!

- Unlock Payz Cashback and VIP Perks with eWalletBooster!

- How to Register for Payz: A Complete Guide + How to Get a Signup Bonus

- Detailed Payz Review: Discover Exclusive Benefits and Features

- Payz Verification Guide 2024: Fast-Track Your Account and Unlock Exclusive Benefits